1996-97 SPx Force Auto Michael Jordan Sells for $82k

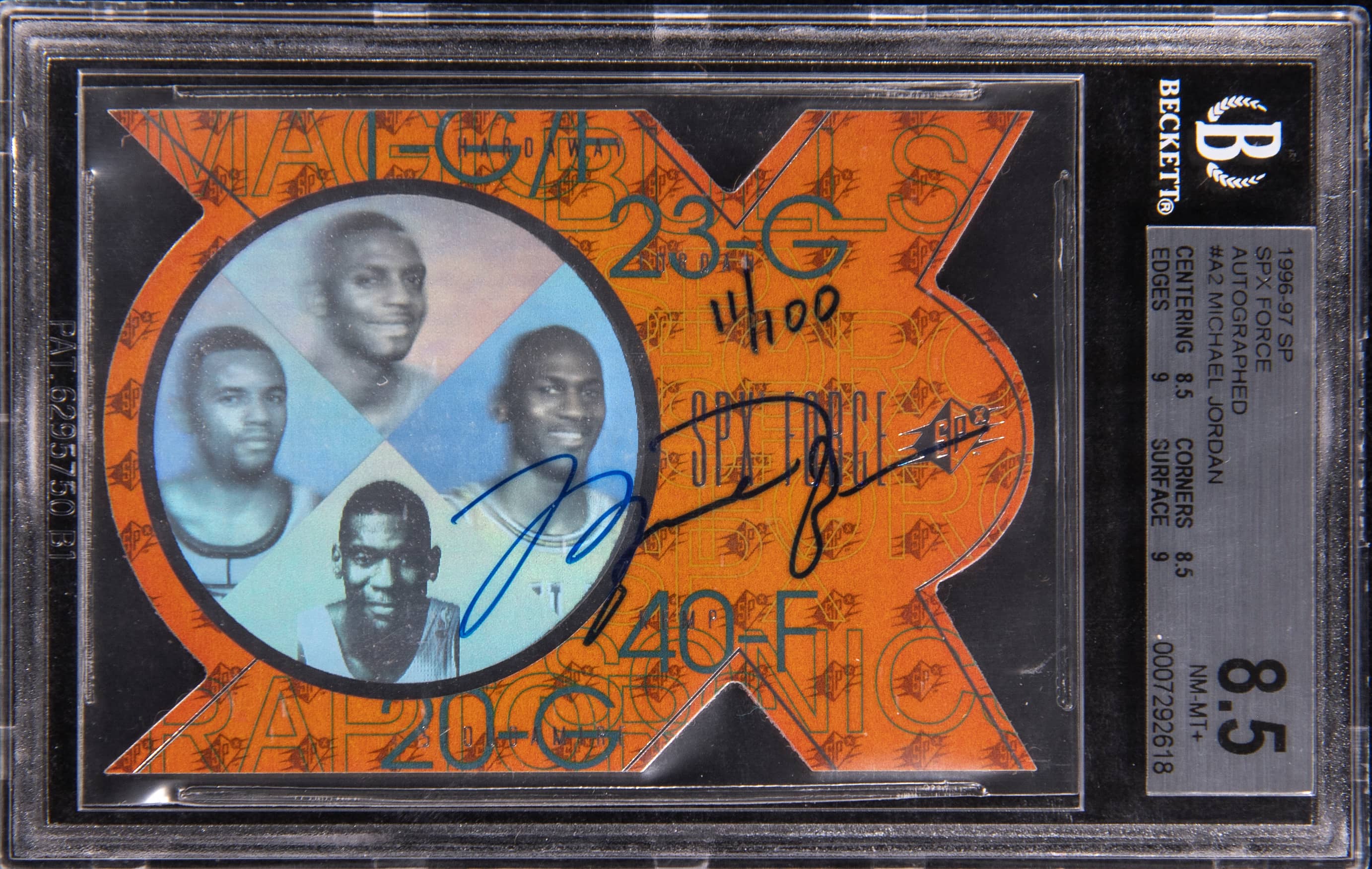

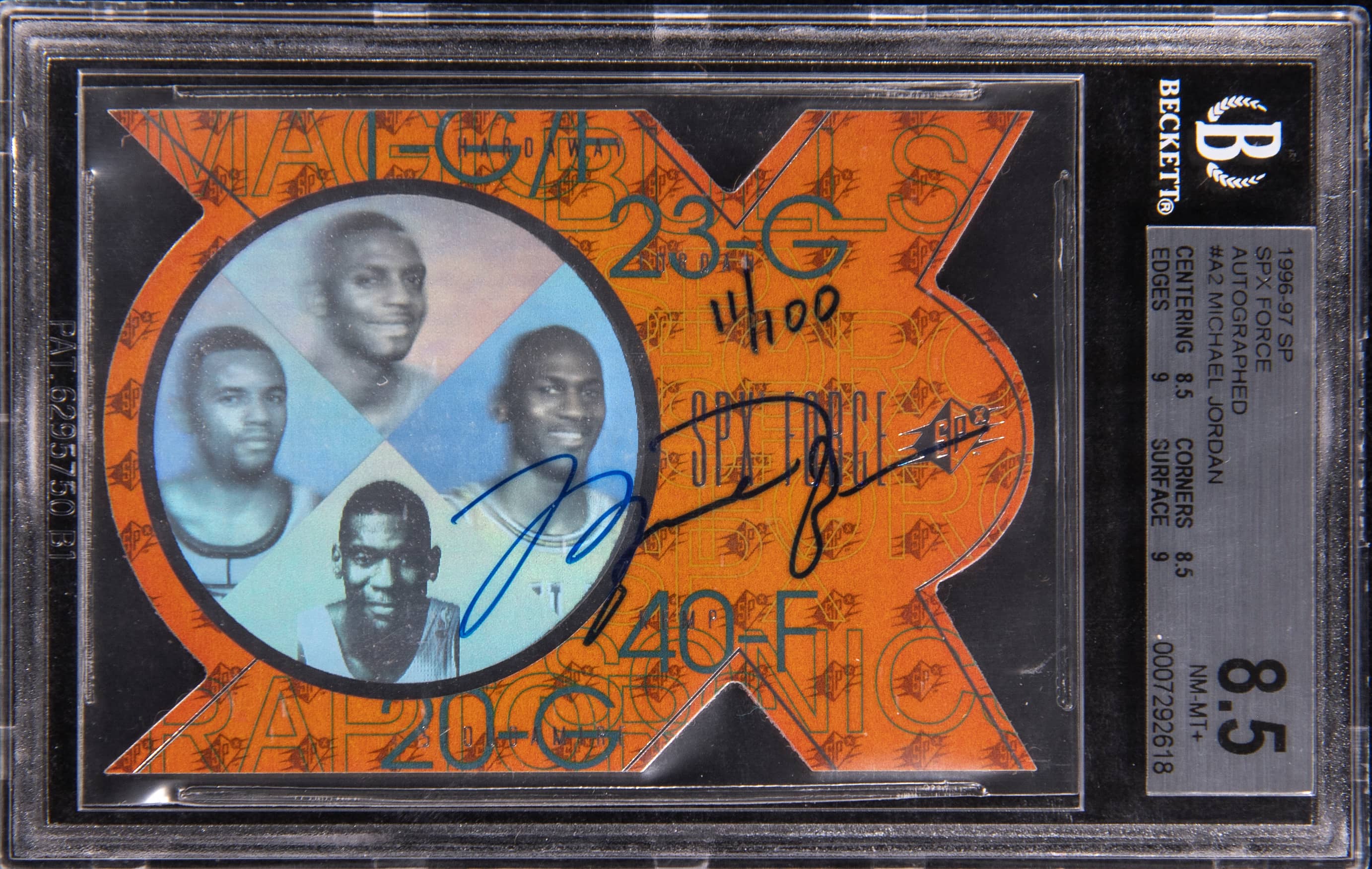

Goldin sold a 1996-97 SP SPx Force Autographed #A2 Michael Jordan BGS 8.5, 10 auto, /100, for $82,960 on Jan 4, 2026. Here’s what it means for collectors.

Sold Card

1996-97 Upper Deck SP SPx Force Autographed #A2 Michael Jordan Signed Card (#11/100) - BGS NM-MT+ 8.5, Beckett 10

Sale Price

Platform

Goldin1996-97 Upper Deck SP SPx Force Autographed #A2 Michael Jordan Signed Card (#11/100) - BGS NM-MT+ 8.5, Beckett 10 Sells for $82,960

On January 4, 2026, Goldin sold a key 1990s Michael Jordan insert: a 1996-97 Upper Deck SP SPx Force Autographed #A2, serial numbered 11/100, graded BGS 8.5 with a Beckett 10 autograph, for $82,960.

For collectors who focus on 1990s basketball inserts and on-card autographs, this card sits in an important lane: it’s a numbered, hard-signed Jordan from a respected mid-90s Upper Deck brand, in a relatively strong card grade with a top-grade signature.

Card breakdown

- Player: Michael Jordan, Chicago Bulls

- Year: 1996-97

- Set: Upper Deck SP – SPx Force Autographed

- Card number: #A2

- Serial number: 11/100 (only 100 copies produced)

- Autograph: On-card, graded Beckett 10 (Gem Mint auto)

- Card grade: BGS NM-MT+ 8.5 (subgrades typically matter, but the headline is strong mid-high grade)

- Era: 1990s insert era (often called the “Jordan insert era”)

This is not a rookie card, but it is a key Jordan issue from the period when inserts, numbered cards, and early premium autographs were reshaping basketball products. SP and SPx helped bridge the gap between basic base sets and the more elaborate modern chromium and patch-auto cards that came later.

Why this card matters to collectors

1. Early, numbered Jordan autograph

Jordan has many autographs in the hobby, but not all are equal in the eyes of collectors. This card checks several boxes that tend to matter:

- Mid-90s issue: Closer to Jordan’s playing days than many later autos.

- Serial numbered to 100: A defined, low print run compared to mass-produced base cards.

- On-card signature: The autograph is signed directly on the card, rather than on a sticker that’s applied later. Many collectors see on-card autos as more desirable and "authentic-feeling" pieces.

Within Jordan’s autograph catalog, early and 90s-era numbered autos are often treated as a different tier from modern, higher-volume releases.

2. SP / SPx brand and 90s insert culture

The mid-1990s marked the rise of insert cards—special, often short-printed cards inserted at lower odds than standard base cards. SP and SPx contributed heavily to that culture:

- SP was Upper Deck’s higher-end brand at the time, known for better card stock and more premium designs.

- SPx pushed toward layered, foil-heavy, and more experimental designs.

For many collectors who grew up in the 90s, these sets represent the transition from the overproduced “junk wax” era into a much more scarcity-aware hobby. When you combine Jordan, a limited serial number, and an autograph in that context, you get a card with strong nostalgic and historical weight.

3. BGS 8.5 with a 10 autograph

Beckett Grading Services (BGS) is one of the legacy grading companies in sports cards. Two components matter here:

- Card grade – 8.5 (NM-MT+): Near Mint-Mint Plus is not a gem (like BGS 9.5 or BGS 10), but it’s generally a clean, attractive copy. In the 1990s, production and handling issues (foil, chipping, surface scratches) often make truly high grades rare.

- Autograph grade – 10: Beckett’s top auto grade signals a bold, complete, and clean signature with no obvious flaws. For autograph-focused buyers, the 10 auto can offset slightly lower card grades.

In many 90s Jordan autos, collectors will often tolerate moderate card wear if the autograph is strong. Here, the combination of an 8.5 card with a 10 auto still positions this copy as a premium example among the 100 printed.

Market context and recent sales

This particular copy sold at Goldin on January 4, 2026 for $82,960 USD.

When analysts and collectors talk about “comps” (short for comparables), they mean recent sales of the same card—or very similar cards—that help give a sense of the current market range.

For a numbered Jordan autograph from the mid-90s, there are two main angles when looking at comps:

- Exact card, different grades: Other copies of the 1996-97 SP SPx Force Autographed #A2 in BGS, PSA, or SGC slabs.

- Similar 90s numbered Jordan autos: Other SP / SPx or comparable 90s-era Jordan autograph inserts with similar scarcity and brand status.

Across recent auction and marketplace data, these kinds of Jordan cards have generally settled into a tier where:

- High-grade examples (especially true gem copies and strong PSA 10s) command a noticeable premium.

- Mid- to high-grade copies with top autograph grades, like this BGS 8.5 / 10 auto, sit slightly below those highest-tier results but still at a clearly elite price level relative to most Jordan cards.

Within that framework, $82,960 aligns with where serious collectors and investors have been valuing notable mid-90s Jordan autos with similar traits—limited numbering, respected brand, and strong grading. The exact premium or discount vs. recent comps will depend on details like subgrades, eye appeal (centering, surface quality, autograph placement), and any provenance or prior public sale history.

How this sale fits into the broader Jordan market

The Jordan market has matured compared to the rapid price swings seen in 2020–2021. While there can still be volatility, especially around big events or headlines, high-end Jordan cards now trade in a more data-aware environment:

- Established hierarchy: Collectors generally recognize a rough “ladder” of importance: rookie cards and iconic 1980s issues, then key 90s inserts and early autos, then modern, higher-volume autos and parallels.

- Insert and auto focus: 90s inserts and early, scarce autographs remain a strong focus area for long-time MJ collectors.

- Grading and eye appeal: Within any serial-numbered run, the best-looking copies with strong grades and top-notch autographs tend to capture the highest prices.

This Goldin sale reinforces the idea that:

- Numbered, on-card Jordan autos from the 1990s continue to attract serious capital and long-term collectors.

- Even outside of his core rookies, there is sustained demand for historically meaningful 90s pieces from premium brands like SP and SPx.

Key takeaways for collectors and small sellers

If you are newer to this part of the hobby—or returning after years away—here are some practical observations from this sale:

Serial numbering matters. A card limited to 100 copies has a built-in scarcity that mass-printed cards simply cannot match. That doesn’t guarantee future prices, but it frames how collectors think about competition for each copy.

Era and brand are part of the story. A 1996-97 SPx Force auto sits in a different lane than a much more recent Jordan auto from a lower-tier brand. The brand’s reputation and the era’s importance matter when you compare prices.

Grade isn’t just one number. The BGS 8.5 / 10 auto split shows how card and autograph grades can be weighed differently. For autograph-oriented cards, a perfect autograph grade can be a strong selling point even if the card isn’t a gem.

Use comps carefully. When researching your own cards, look at:

- The exact same card and parallel

- The same grading company and similar grades

- Actual realized prices (not just asking prices) from established auction houses and major marketplaces

Context over headlines. Seeing a single sale at $82,960 is informative, but it’s most useful when viewed alongside:

- Other recent sales of the same card

- Market behavior for similar Jordan autos

- Broader demand for 90s inserts and autos as a category

Final thoughts

The January 4, 2026 Goldin sale of the 1996-97 Upper Deck SP SPx Force Autographed #A2 Michael Jordan—serial numbered 11/100 and graded BGS 8.5 with a Beckett 10 autograph—at $82,960 highlights the ongoing strength of mid-90s Jordan autographs that combine scarcity, a respected brand, and a premium on-card signature.

For collectors building a Michael Jordan portfolio or studying 90s basketball inserts, this card is a clear reference point: not a rookie, but a historically important, limited-run, on-card autograph that continues to attract significant attention whenever a strong example surfaces at auction.

As always, use sales like this as data points rather than predictions. The more you track actual realized prices, the better feel you’ll develop for how the market values specific Jordan cards across eras, sets, and grades.